Is Mold Remediation Covered by Insurance Policies?

When it comes to dealing with mold issues, insurance coverage can be a significant concern. Mold growth can cause extensive damage to your property and even pose health hazards. That’s why it’s crucial to understand whether mold removal is covered by insurance policies.

In this article, we will explore the specifics of insurance coverage for mold removal expenses. We will discuss mold remediation insurance, mold insurance claims, coverage for mold damage, and other related topics.

Key Takeaways:

- Insurance policies may cover mold removal, but it’s important to review your policy carefully and consult with your provider to determine the extent of your coverage.

- Not all insurance policies cover mold removal, so it’s worth checking your policy details or contacting your insurer to see if mold remediation is covered.

- Mold remediation is a crucial process that involves addressing mold issues promptly to prevent further damage and potential health risks.

- If you are facing mold issues, filing a mold insurance claim can help you receive coverage for removal expenses.

- Taking preventative measures to minimize the risk of mold in your property is equally important as having insurance coverage for mold remediation.

Understanding Mold Remediation

Before discussing insurance coverage, it’s crucial to understand what mold remediation entails. Mold remediation is the process of identifying and removing mold from a property to prevent further spread and damage.

The process typically involves:

- Initial assessment of the mold issue and the extent of the damage

- Containing the mold to prevent further spread

- Using specialized equipment and cleaning agents to remove the mold

- Drying and dehumidifying the property to prevent future mold growth

- Repairing and replacing any damaged structures or materials

It’s essential to address mold issues promptly, as untreated mold can cause significant property damage and lead to health issues. For example, some molds can cause allergic reactions or respiratory problems in susceptible individuals.

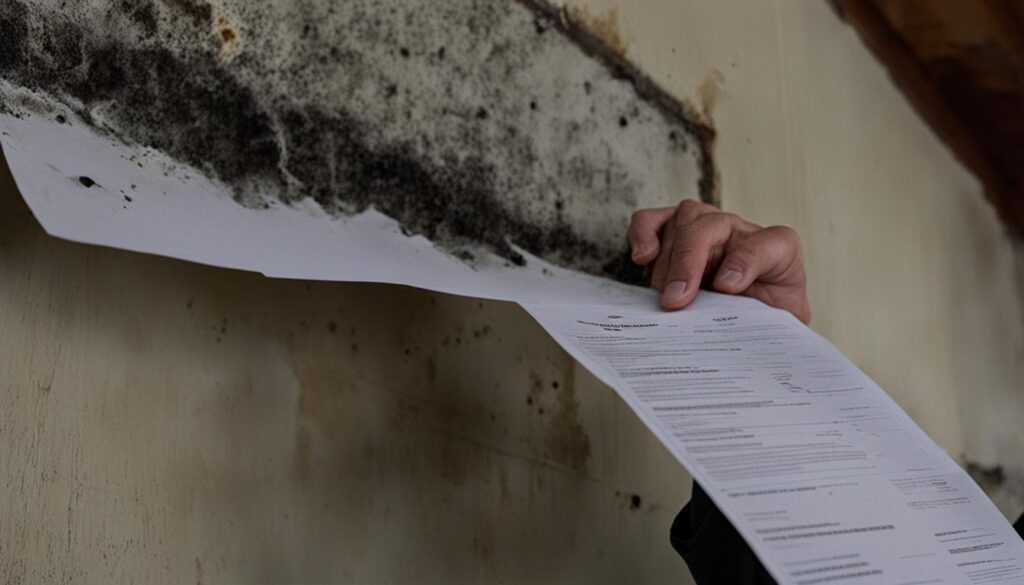

Check out the image below to see a detailed overview of the mold remediation process:

The Mold Remediation Process

| Step | Description |

|---|---|

| Assessment | Evaluate the mold situation and determine the extent of the damage |

| Containment | Isolate the contaminated area to prevent further spread of mold spores |

| Remediation | Use specialized equipment and cleaning agents to remove the mold |

| Drying and Dehumidifying | Ensure that the property is thoroughly dried and dehumidified to prevent future mold growth |

| Repair and Renovation | Fix any damage caused by the mold, including repairing or replacing damaged structures or materials |

As you can see, mold remediation is a complex and detailed process that requires professional expertise. Consider contacting a mold removal specialist like Fix Mold Miami at 305-465-6653 to ensure your mold issues are resolved effectively.

Types of Insurance Policies That May Cover Mold Removal

When it comes to insurance coverage for mold removal, not all policies are created equal. However, there are certain types of insurance policies that may include coverage for mold remediation expenses. Knowing what insurance policies may cover mold removal can save you significant financial strain if you’re dealing with a mold issue in your property.

Here are some types of insurance policies that may cover mold removal:

| Insurance Policy | Description |

|---|---|

| Homeowners Insurance | Most homeowners insurance policies include coverage for mold remediation, but the extent of coverage varies. Some policies have exclusions for certain types of mold or only cover mold damage if it is caused by a covered peril, while others specifically include mold coverage in the policy. |

| Commercial Property Insurance | If you own a commercial property, your insurance policy may cover mold removal expenses. Similar to homeowners insurance, coverage for mold remediation varies depending on the policy. |

| Flood Insurance | Flood damage can often lead to mold growth, and flood insurance policies may include coverage for mold removal resulting from flood damage. |

It’s essential to review your insurance policy to know what coverage is provided for mold remediation expenses and what requirements must be met to file a mold removal insurance claim. Additionally, it is crucial to understand any limitations or exclusions that your policy may have concerning mold remediation.

Policy Coverage for Mold Remediation

It’s important to understand the coverage your insurance policy provides for mold remediation. Most policies cover remediation costs if the mold is the result of a covered peril, such as water damage from a burst pipe.

Typically, insurance coverage for mold removal includes the cost of remediation, including cleanup and repairs to damages caused by the mold. Some policies may also cover additional expenses, such as temporary housing if the remediation renders your home uninhabitable.

However, it’s essential to check your policy for any limitations or exclusions that may apply. Certain policies may limit coverage for mold removal to a specific dollar amount or exclude coverage altogether for certain types of mold.

Filing Mold Insurance Claims

Dealing with mold issues can be a stressful and expensive process, which is why it’s crucial to understand the steps for filing mold insurance claims. First, review your insurance policy to ensure that you have coverage for mold removal expenses. If you do, take photos of the affected areas and document the damage. Next, contact your insurance provider to report the mold issue and start the claims process.

Be prepared to provide details about the cause of the mold, the extent of the damage, and any previous mold assessments or remediation efforts. Your insurance provider may send out an adjuster to assess the damage and determine the coverage amount for your claim.

It’s important to remember that insurance companies may have specific deadlines and requirements for filing mold insurance claims, so be sure to follow their instructions carefully. Keep detailed records of all communication with your insurance provider and any expenses related to mold removal, including receipts and invoices.

Maximizing your chances of receiving coverage for mold removal expenses is crucial, and having professional assistance can make a significant difference. Companies like Fix Mold Miami offer mold assessments, prevention, and remediation services, helping you navigate the claims process and get the coverage you deserve. Contact 305-465-6653 to schedule a mold inspection for your home or business and get the help you need.

Mold Damage and Insurance Coverage

Mold damage can cause a range of issues in a property, and addressing them can be both time-consuming and expensive. Fortunately, many insurance policies cover mold damage, which can provide peace of mind for property owners.

One of the primary factors that insurers consider when assessing mold damage claims is the cause of the mold growth. If the mold damage results from a covered event, such as a burst pipe or roof leak, it is more likely to be covered by insurance. However, if the mold is the result of prolonged humidity or other preventable factors, the insurance company may deny coverage.

It’s important to note that insurance policies vary widely in the level of mold damage coverage they provide. Some policies may offer only limited coverage or exclude specific types of mold damage entirely. For this reason, it’s crucial to review your policy in detail to understand what is and isn’t covered.

When filing a mold damage insurance claim, you will need to provide detailed documentation of the damage and the cause of the mold growth. The insurance company may also require an independent assessment of the damage to confirm the extent of the damage and determine the appropriate course of action for remediation.

Potential Limitations on Mold Damage Coverage

While mold damage coverage can be valuable, it’s important to remember that insurance policies may have specific limitations or exclusions. For example, some policies may only cover a portion of the damage or limit the amount that is paid out per claim. Others may exclude coverage for mold in certain areas of the property, such as basements or crawl spaces.

It’s also important to note that insurance companies may require policyholders to take action to prevent mold growth, such as addressing leaks promptly or maintaining adequate ventilation in humid areas. Failure to take these preventive measures may result in a denial of coverage for mold damage.

Black Mold and Insurance Coverage

Black mold, also known as Stachybotrys chartarum, is a type of fungus that produces mycotoxins and can pose a serious health risk to humans and pets. Removing black mold can be a complicated and expensive process, so it’s natural to wonder if insurance policies cover it. However, the answer is not straightforward – it depends on the specifics of your policy and the circumstances surrounding the mold growth.

In general, most insurance policies cover mold removal only if it resulted from a covered peril, such as water damage from a burst pipe. However, policies may exclude coverage for mold that results from long-term neglect or inadequate maintenance. It’s essential to review your policy carefully and check with your insurance provider to determine if black mold removal is covered by your policy.

If you do have coverage for black mold remediation, it’s crucial to follow the correct procedures when filing a claim. Take the time to document the damage, including photos and written descriptions of the affected areas, and keep a record of all expenses related to the mold removal. A mold remediation specialist can help you with these documentation requirements.

What to Do if Black Mold is Found in Your Property

If black mold is found in your property, it’s essential to address the problem promptly. Contact a reputable mold remediation professional who can assess the situation and determine the extent of the damage. They can also provide guidance on the next steps to take, including ensuring that the mold is contained and assessing whether it poses a health risk.

“Black mold is nothing to mess around with. It’s critical to tackle the issue head-on and take all necessary measures to remove it from your property.”

While the cost of black mold removal can be significant, it’s not something that should be ignored or left untreated. The potential health risks and property damage are too severe to take lightly. If you are concerned about black mold in your property and its coverage under your insurance policy, consult with a professional mold remediation service for guidance.

The Importance of Preventing Mold Issues

While insurance coverage is important for mold remediation, it is equally crucial to take preventive measures to stop mold issues from developing in the first place. Mold prevention should be a part of every property owner’s routine maintenance plan.

One effective way to prevent mold is to schedule regular mold assessments and inspections. Mold assessments are conducted to determine if there is an existing mold problem, while mold inspections are done to identify potential areas where mold is likely to develop. These essential services are performed by licensed professionals with the expertise and equipment to detect hidden mold and provide recommendations for remediation and prevention.

Another critical aspect of mold prevention is controlling the moisture levels in your property. Mold thrives in wet and humid environments, so maintaining proper ventilation and utilizing dehumidifiers in high humidity areas, such as basements and bathrooms, can drastically reduce the risk of mold growth.

It’s also essential to address any leaks or water damage promptly. If left unchecked, even minor water damage can provide the ideal conditions for mold growth, leading to more significant problems down the line.

By implementing a comprehensive mold prevention strategy that includes regular assessments, moisture control, and timely repairs, property owners can safeguard their homes and businesses from the harmful effects of mold.

Conclusion

In conclusion, it’s important to understand that mold remediation may or may not be covered by insurance policies. It’s crucial to review your insurance policy carefully to determine the extent of your coverage and consult with your insurance provider. Even if you have coverage for mold removal, it’s important to act promptly when you notice mold in your property to prevent further damage and health hazards.

Take steps to prevent mold issues by scheduling regular mold assessments and inspections. Services like Fix Mold Miami can help you prevent, assess, and remediate mold in your home or business.

Remember, mold can cause significant damage, including structural issues and health hazards. If you suspect mold in your property, don’t wait – take action today.

FAQ

Is mold removal covered by insurance?

Insurance coverage for mold removal depends on the specific policy. Some insurance policies may include coverage for mold remediation, while others may have exclusions or limitations. It is important to review your insurance policy and consult with your insurance provider to understand the extent of coverage for mold removal expenses.

What types of insurance policies may cover mold removal?

Homeowner’s insurance and commercial property insurance are two types of policies that may include coverage for mold removal. However, it is essential to review the policy language and consult with your insurance provider to determine the specific coverage and any limitations or exclusions that may apply.

What is the typical coverage for mold remediation?

The coverage for mold remediation varies depending on the insurance policy. Generally, insurance may cover the costs of mold assessment, mold removal, and necessary repairs. However, there may be limitations on the coverage amount and exclusions for certain circumstances, such as mold caused by long-term neglect or lack of maintenance.

How do I file a mold insurance claim?

To file a mold insurance claim, you should notify your insurance company as soon as you discover the mold issue. Provide them with all relevant details, including documentation of the mold problem, assessments, and receipts for any mitigation efforts. It is advisable to consult with a professional mold remediation company to ensure proper documentation and facilitate the claims process.

Is black mold removal covered by insurance?

The coverage for black mold removal depends on your insurance policy. Some policies may include coverage for the remediation of black mold, while others may have exclusions. Review your policy language, consider consulting with your insurance provider, and provide them with evidence of the black mold issue to determine the coverage available.

How can I prevent mold issues in my property?

Preventing mold issues is crucial to avoid potential damage and health hazards. Regular mold assessments and inspections can help identify and address moisture problems promptly. Proper ventilation, humidity control, and prompt repairs of water leaks can also mitigate the risk of mold growth. Additionally, regular cleaning and maintenance can help prevent mold from developing in damp areas.